You Are Our Voice.

Tasmania is at a defining moment for animal welfare.

The greyhound racing industry are pulling out all stops to try and prevent the Tasmanian Government’s proposed greyhound racing ban passing Parliament.

Help us raise the funds we need to fight back.

Legislation currently before the Tasmanian Parliament proposes a phased transition away from commercial greyhound racing by 2029. This Bill offers a clear, responsible pathway to end an industry that causes predictable harm — but it is being fought every step of the way by the greyhound racing industry.

Greyhounds are no different from any other dog. They feel pain, fear, and distress. Whether through racing or breeding, the industry exposes them to both immediate injury and long-term physical and psychological suffering that would be unacceptable for dogs in any other setting. Dogs bred and raced for gambling do not live the lives they should — lives spent in loving homes, part of a family, safe, cared for and free from harm.

This is a once in a generation opportunity to end greyhound racing in Tasmania.

Your support helps fund us fight back against the greyhound racing industry and fund the advocacy needed to pass the bill into law.

Greyhounds cannot speak for themselves. Be their voice.

Thank you.

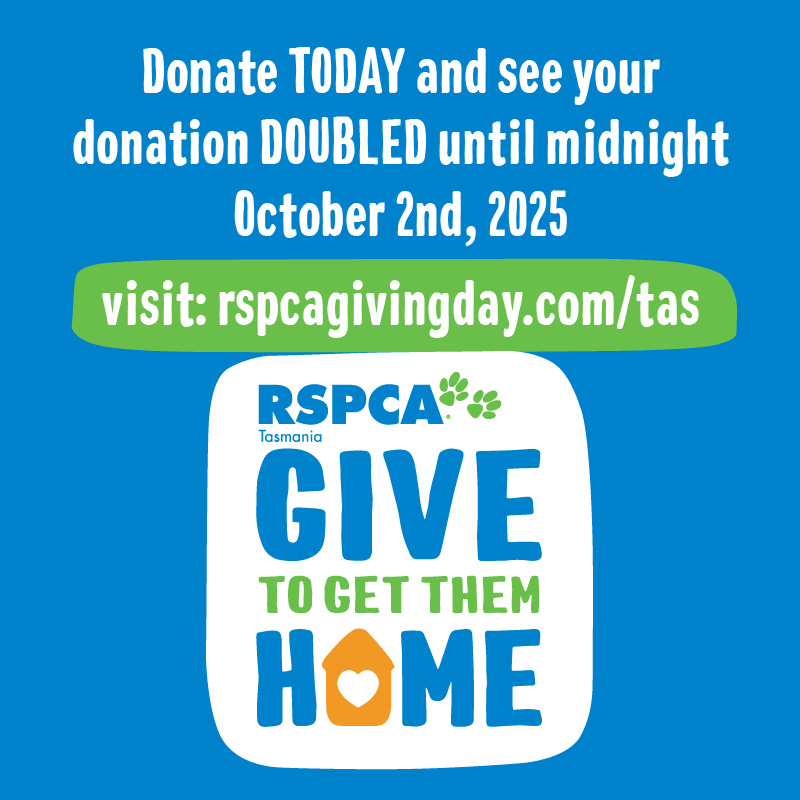

Donate today and help end greyhound racing in Tasmania.

Andrea Dawkins

CEO, RSPCA Tasmania

[photo:Kimba, Goldie, and Andrea Dawkins]

" " indicates required fields

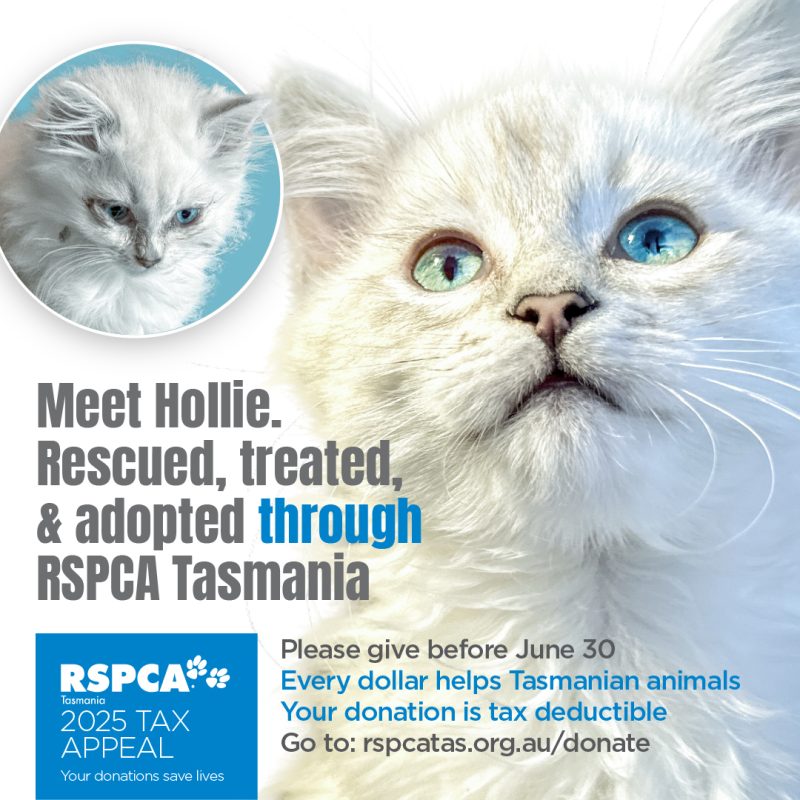

Thank you Royal Canin for helping us feed nutritious meals to these hungry animals.

Donor Promise

Make a difference – Your passion for animal welfare will be reflected in our dedication and hard work

Share – You will always know the impact of your gift and will have full access to RSPCA state and territory annual reports

Listen – Your wishes and requests will be listened to and acted upon wherever possible

Respect – Your relationship and interactions with us will be based on mutual respect

Be Responsible – Your gifts will be used to fund the most vital work across the state

Protect Your Information – Your personal information will never be sold or traded to other charity brands